This central economic principal functions in digital because, as we all know, there’s an almost endless possibility of inventory supply, across an infinite sprawl of websites and a publisher’s ability nowadays to create additional pages of content at relatively low cost and certainly for less than they could when they had to print more pages of content to accommodate more pages of advertising.

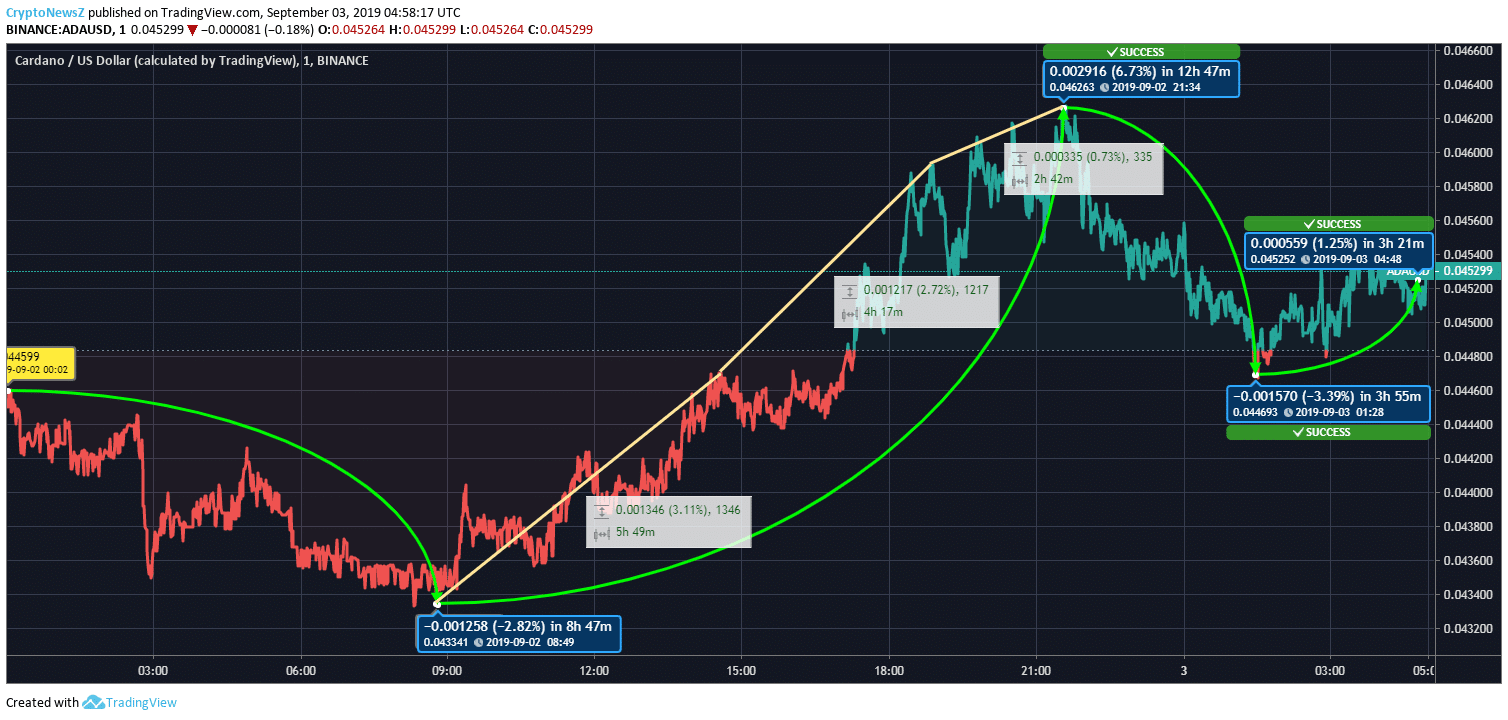

#ONINE ADA PRICING TV#

In the days when TV and print were the ruling class, marketers would have fallen over themselves for even $5 CPMs, especially when considering these digital CPMs are for narrowly targeted, cherry-picked audiences.Īnother force that has pressed down the cost of advertising is inventory versus demand. In digital, in the first quarter of 2018, the average CPM on the Google display network was $2.80. Where once marketers bought and hoped, and in the case of the Upfronts, bought and hoped well in advance, they can now target and measure in near-real time their return on investment and, if they’re not happy with it, they can make iterative adjustments until they reach their sweet spot.Īdvertisers paid an average CPM of $17.50 for cable TV ads at the Upfronts for the 2018-2019 season. In the days when TV and print were the ruling class, marketers would have fallen over themselves for even $5 CPMs, especially when considering these digital CPMs are for narrowly targeted, cherry-picked audiences.Įfficiency of the pricing is another important element in this shift. According to Statista, advertisers paid an average CPM of $17.50 for cable TV ads at the famous Upfronts for the 2018-2019 season, when many of the deals are sealed ahead of time as content and marketers negotiate for preferred spots. There’s no sign that it will climb from there to previous levels, and there could even be indicators it will decline more.ĭigital advertising has clearly ushered in this era with less waste and lower CPMs, or cost per every thousandth person reached. on advertising dropped for the first time from 2010 to 2018 to below 1%, to. GDP since at least the 1950s, spending in the U.S. And who doesn’t like a deal?Īfter remaining at a consistent 1.2 to 1.4% of U.S. In spite of complaints about precision targeting becoming prohibitively expensive at scale and concerns about the duopoly controlling the industry itself, which you’d think would float higher prices, marketers, in fact, are able to do more with less. Take a birds’ eye view of advertising, be dispassionate and not influenced by wherever you sit in the ecosystem, and you’ll see the neon sale signs everywhere you look. Spending on Advertising as Share of GDP, from Robert Coen, WARC, BEA, PPI Progressive Policy Institute There’s no sign that it will climb from there to previous levels, and there could even be indicators it will decline more. 96%, according to the Progressive Policy Institute, whose groundbreaking work on this topic I also cited in the earlier piece. on advertising dropped in the period from 2010 to 2018 to below 1%, to. After remaining at a consistent 1.2 to 1.4% since at least the 1950s, spending in the U.S. However, recently, digital ad pricing has caused a disconnect in that historic narrative. GDP has remained at a constant percentage for decades, as I heard from a putative expert on the topic for years. Historically, advertising spend as a relative portion of the U.S.

#ONINE ADA PRICING DRIVERS#

In that piece, I made mention of how pricing in digital has been one of the real main drivers of the shift from traditional publishers to the digital natives-and the understandable consternation that traditional publishers have felt under the pressures of reduced pricing for their inventory.

I recently wrote about some of the myths clouding the antitrust movements against tech giants, on federal and state levels.

0 kommentar(er)

0 kommentar(er)